Last year congress passed a bill that empowered the Fed to cap the fees large banks charge retailers for debit card transactions. As a result, big banks have lost a significant source of revenue and have responded by increasing the fees they charge their customers.

By now you have probably heard all the commotion caused by Bank of America’s announcement that they will begin charging a $5 monthly fee to all their debit card customers. The fee will go into effect in the new year and it’s reported that other big banks will soon follow. While changing banks is one way to avoid the newly imposed fee, there is nothing preventing your new bank from adding a debit card fee, too.

So here are a few ways you can guarantee you won’t be hit with a debit card fee:

Cash

One way to beat the fee is to adopt a cash only policy. This method of money management has been around since the beginning of time and some think it’s the best way to manage your money. The financial guru’s we know and love like Suze Orman and Dave Ramsey both have stated time and time again that using cash is better than using any sort of plastic. There are no interest charges and sometimes just seeing your money leave your wallet is enough to keep your spending in check.

Credit Cards

While some think credit cards are just plain evil, there are may perks to paying for your purchases with a credit card. For one, you can avoid the Bank of America fee and you can also save yourself some money if you use a cash back credit card. Getting the most out of your card requires being responsible with your spending habits and always paying your balance off each month. You can also build your credit with a credit card and many cards offer warranty programs to protect your purchases.

Prepaid Cards

Prepaid cards tend to get a bad wrap. They have a reputation of catering to people with bad credit and those who can’t obtain a traditional bank account. It appears the times are changing and now people of all credit ranges are using prepaid cards as a way to manage their spending. Prepaid cards require the user to load money to the card before making a purchase. As a result, the account can’t be over-drafted because you can only spend the amount on the card. Some of the best prepaid cards come with no or limited fees. And because prepaid cards were excluded from the Fed’s action on debit cards, it’s unlikely that banks will starting increasing the fees on these cards.

Credit Union

Some people swear by Credit Union’s because frequently they offer lower rates and have a tendency to give more personable service than the big banks. Credit Unions are also able to avoid some of the red tape with their long time customers which makes borrowing a much simpler process. They provide many of the same services banks provide, but often with no fees or significantly lower fees.

This is a guest post from Michal who is a senior editor at Dough Roller and Credit Card Offers IQ.

Related Posts

The post How To Avoid Debit Card Fees appeared first on Smart On Money and was written by Contributor.

Copyright © Smart On Money - please visit smartonmoney.com for more great content.

Insurance, Renting, Cell Phones, and Jobs

Insurance, Renting, Cell Phones, and Jobs

At some point, I’ll probably cut off the credit card offers. And I’ll also want to stop the flow of other junk mail. The good news is that it’s possible to do this — do it fairly easily. You have to online stops to make:

At some point, I’ll probably cut off the credit card offers. And I’ll also want to stop the flow of other junk mail. The good news is that it’s possible to do this — do it fairly easily. You have to online stops to make:

The technology that would be used by cell phones in this manner is called near-field communications (NFC). However, many stores don’t have NFC capabilities with their card readers. The result is that, until more stores adopt this technology, you need to store your payment information attached to a barcode, or use some other method (Home Depot, for example, allows you to access your PayPal information and pay with PayPal at its terminals).

The technology that would be used by cell phones in this manner is called near-field communications (NFC). However, many stores don’t have NFC capabilities with their card readers. The result is that, until more stores adopt this technology, you need to store your payment information attached to a barcode, or use some other method (Home Depot, for example, allows you to access your PayPal information and pay with PayPal at its terminals).

As overwhelming as it may seem, there are some simple things you can do to

As overwhelming as it may seem, there are some simple things you can do to

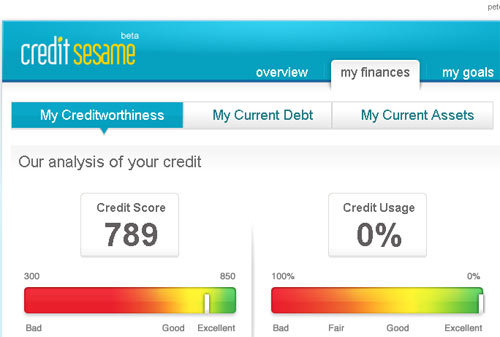

There are ways to get free credit scores, including

There are ways to get free credit scores, including